- System Administration

- Introducer Portal

- Loan Assessment System

- Settlement Management System

- Customer Relationship Management

- Generative AI-Powered Brokerage System

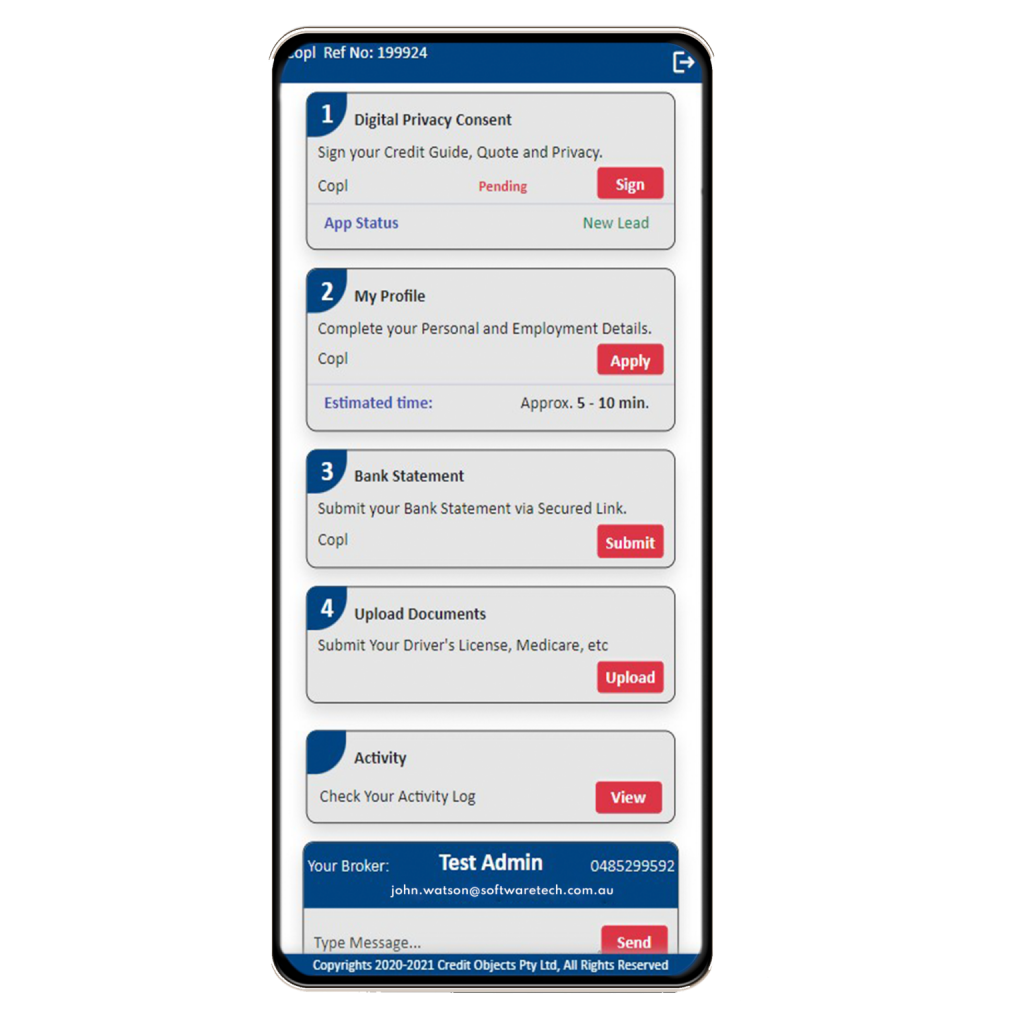

Credit Objects mini applications make it is easier for the customers to readily provide information without much interaction with the brokers. Saving time and money for the company.

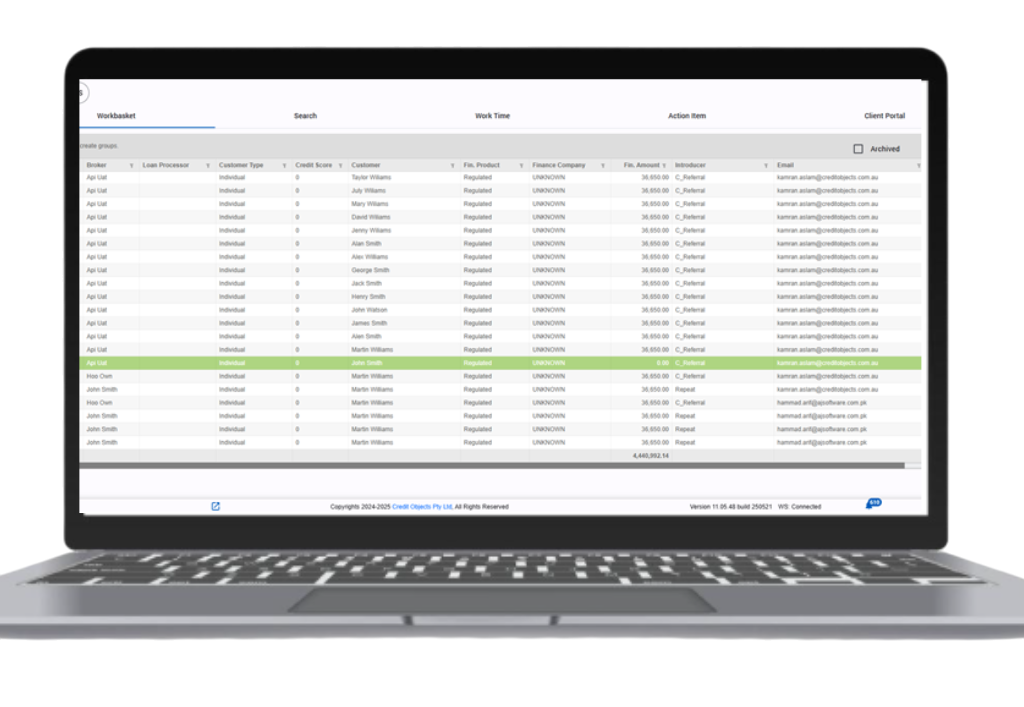

Customers can feed in data directly into Credit Objects via various automated forms. The Built-in Email Management System linked with Customer Database helps in Re-targeting and marketing.

Data security checks are in place at various stages. Anti-fraud checks and secure links in data gathering add another security layer. Credit Objects is packed with customizable reports and informative dashboards.

Credit Objects AI Assistant uses advanced artificial intelligence to enhance various aspects of the lending process including but not limiting to Guiding client through data entry, automatic analysis of loan application, auto verification of settlement condition and many mare.

Copyright © 2025 All Rights Reserved.