- System Administration Module

- Point of Sale

- Settlement Management System

- Contract Management System

- Customer Relationship Management

The Lender Platform by Credit Objects is a comprehensive digital loan management solution designed to manage the complete lending lifecycle within a single, connected system. Built for lenders, asset finance providers, brokers, dealers, and insurers, the platform brings together loan origination, assessment, settlement, and contract management. By consolidating multiple lending processes into one platform, teams can reduce manual effort while improving turnaround times, and can also maintain consistent control across every stage of lending.

The platform manages the full loan lifecycle from customer onboarding and credit assessment through settlement, servicing, and closure. Each module is designed to automate critical steps while enforcing credit policies, approval rules, and compliance requirements. Information flows seamlessly across modules, ensuring consistency and eliminating duplication. A flexible configuration engine allows lenders to define products, workflows, and user access without code changes, enabling the platform to adapt as business and regulatory needs evolve.

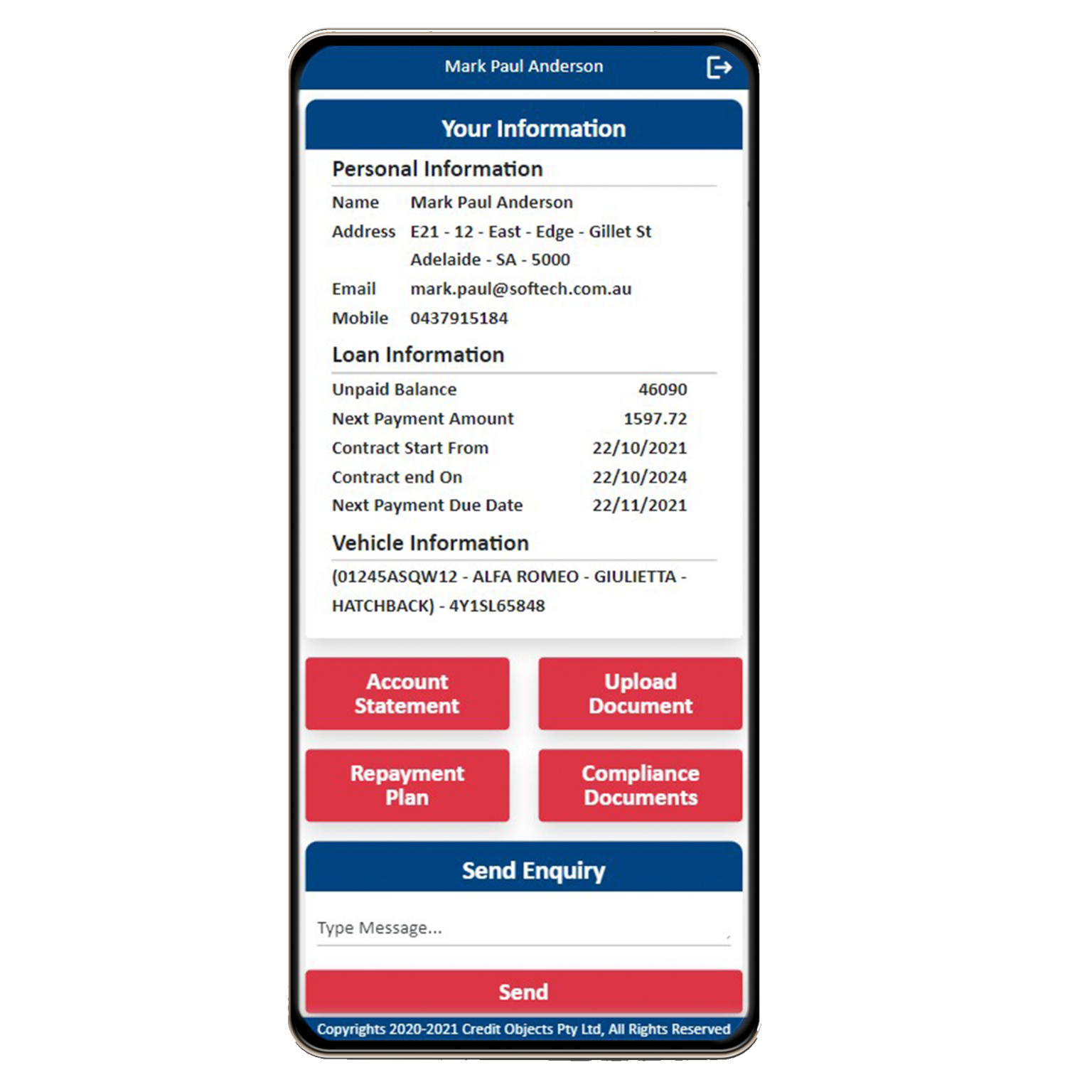

Customer Portal – A Snapshot of Loan Information for Your Clients

Customer Portal is specifically designed for Customers to track their loan information including unpaid balance, next installment amount and due date, and contract information. If required, customers can submit documents directly via Customer Portal. Customers can also contact the assigned lender via Customer Portal in case of any queries.

AI capabilities are embedded across the lending lifecycle to enhance decision–making, accuracy, and efficiency. These capabilities support guided data capture, document analysis, anomaly detection, credit assessment, settlement verification, and ongoing contract monitoring strengthening risk control while reducing processing time.

Speeds up application completion with smart prompts, structured fields, and real-time validation reducing missing information and rework.

Checks documents for completeness and consistency, flags gaps early, and helps ensure lender and compliance requirements are met before submission.

Assesses applicant creditworthiness using bureau data, income and affordability signals, and risk indicators improving decision confidence and faster approvals.

Tracks settlement and post-approval obligations, monitors ongoing contract performance, and alerts on exceptions supporting proactive risk management throughout the loan term.

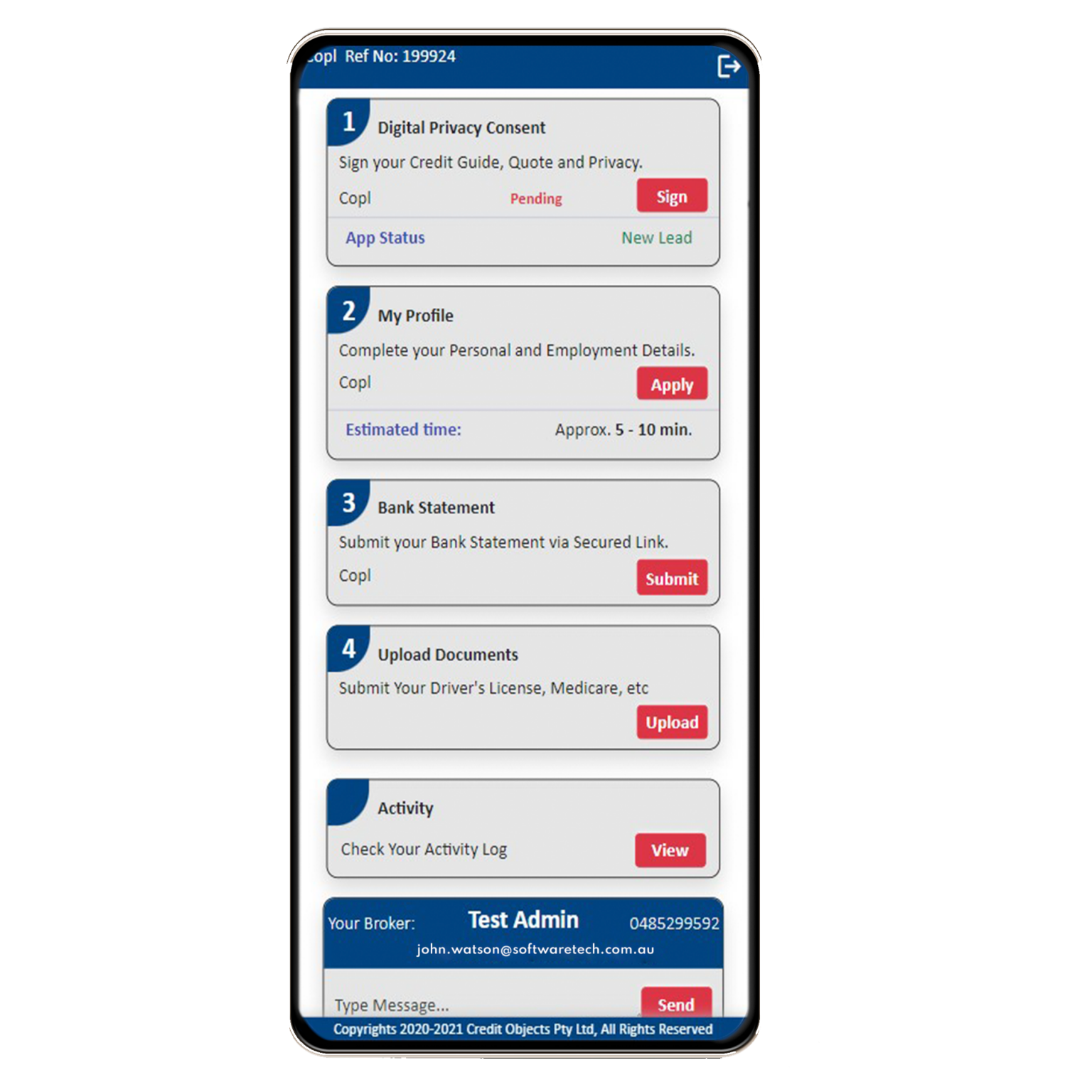

Credit Objects mini applications make it is easier for the customers to readily provide information without much interaction with the brokers. Saving time and money for the company.

Customers can feed in data directly into Credit Objects via various automated forms. The Built-in Email Management System linked with Customer Database helps in Re-targeting and marketing.

Data security checks are in place at various stages. Anti-fraud checks and secure links in data gathering add another security layer. Credit Objects is packed with customizable reports and informative dashboards.

Credit Objects AI Assistant uses advanced artificial intelligence to enhance various aspects of the lending process including but not limiting to Guiding client through data entry, automatic analysis of loan application, auto verification of settlement condition and many mare.

High-impact outcomes delivered through automation, robust controls, and end-to-end visibility across the lending lifecycle.

Applies policy rules, data checks, and risk signals to support faster, consistent approvals reducing manual assessment effort.

Identifies early risk, prioritises accounts, and supports automated follow-ups improving recovery outcomes and reducing delinquencies.

Automates condition checks, document readiness, and settlement preparation reducing exceptions and last-minute rework.

Provides real-time pipeline and exception visibility enabling proactive management across teams and lenders.

Copyright © 2025 All Rights Reserved.